External Forces and Trends

Issues That May Define 2022 and Beyond

As we move further into the 2020s, we are starting to get a better understanding as to how the rest of this decade might shape up. The big story of 2020 and 2021 was the Covid pandemic. The all-consuming discussion of this unprecedented global event has tended to drive all other stories off the front pages. However, that doesn’t mean that the forces shaping the global economy before 2020 have disappeared. They are very much still with us.

- Climate change and Carbon Net Zero

2021 was the year that the media woke up to the urgency of the climate change threat and the sheer magnitude of the measures to be taken to mitigate it. The economic impact alone of doing nothing is likely to be far worse than the cost of the shift to Net Zero. Even so, we are talking about a massive change here. As Ed Conway, Economic Editor of Sky News put it, we will need to re-do the Industrial Revolution:

“The reality is there have been a panoply of different revolutions in industrial production over the past few centuries. The clichéd Dickensian vision of the Industrial revolution somewhat underplays the diversity of innovation that happened then – but continued to happen well into the 20th century. We literally need to do it all over again. Not just that: unlike in the Industrial Revolution, which was really spread out over centuries, we are aiming to do this in a matter of decades.”

To have any chance of achieving the targets set by governments, much of the work of reconfiguring entire economies and business models will define and frame this decade.

- Return of Synchronised Stagnation

The slowing down of the major economies, described in 2019 by the FT’s Chris Giles as synchronised stagnation, looks set to re-emerge. 2019 was the worst year for GPD growth since the 2008 crash. Once the post-pandemic rebound has played out, forecasters expect the rate of growth to slow to something like that of the 2010s. In some economies, it already has. The optimism that suggested the pandemic would be a creative shock to re-set economies, or that the rapid forced adoption of new technologies would usher in a new age of rapid productivity growth, now looks to have been misplaced, at least in the short-to-medium term. Continuing uncertainty and the threat of new Covid waves are dampening business confidence. As one economist remarked to the FT, “The easy part of this recovery appears to be over.”

- Ageing populations

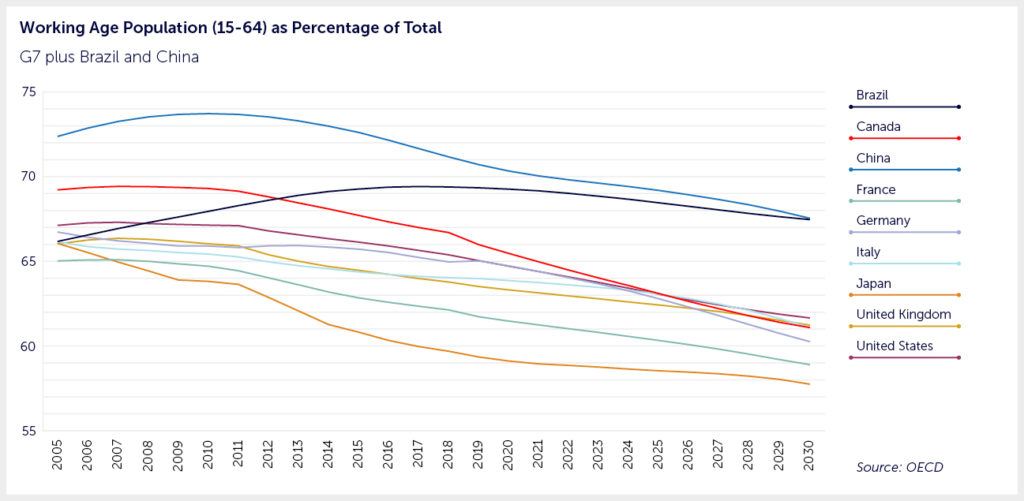

This critical pre-pandemic headwind will start to hit many major economies this decade. The baby bust, which saw birth rates fall during the pandemic, will only add to a phenomenon that was already gathering pace. Working age populations are declining as a proportion of the total and are falling in absolute terms in countries such as France, Germany and Japan. The OECD expects the UK’s to do so from 2028. This affects emerging economies too. China’s working age population will shrink by some 30 million over the course of this decade.

Inevitably, this will lead to labour shortages and the global nature of the problem means that immigration will no longer be a solution. As the push for Net Zero leaves countries needing the same skills at the same time, periodic labour shortages are likely to be a recurring story of the 2020s.

- Inflation, energy costs, and the living standards crunch

In 2021, many economies experienced the return of inflation to levels not seen for decades. Much of this was due to the mismatch of supply and demand. The release of pent-up demand, while supply chains were still disrupted by the pandemic led to price rises. While forecasters expect energy prices to stabilise during 2022, the market may be influenced by political factors. Deteriorating relationships between the West and resource-rich powers such as Russia may aggravate the problem. It is likely that rising energy prices will fuel inflation in many countries. The UK’s Resolution Foundation expects any relief resulting from post-pandemic wage rises to stall and 2022 to be “the year of the squeeze”.

- Volatile politics

After three decades in which overall trade barriers were lifted, regulations were reduced, and doing business globally became easier, we are now seeing the re-emergence of politics as a significant economic factor. Even without the brinkmanship of Donald Trump and the re-construction of trade barriers between the UK and EU (neither of which most business strategists saw coming) the political environment was always likely to become more difficult as US dominance was eroded and China asserted itself. The US role in setting the global trade agenda is now contested in a number of areas. The increasing volatility in international politics is changing the rules of the game. While some commentators argue that we have reached ‘Peak China’, others warn that its slowdown may make it more aggressive in the short term. Whatever happens, geopolitics will continue to dominate the trading environment.

- Increased government debt

All governments have been left with higher debts after their necessary interventions during the Covid pandemic. This came on top of the increased debt-to-GDP ratio for many countries that resulted from the 2008 financial crisis. As the investment cost for Net Zero needs to be factored into government forecasts and the upward pressure on pension and healthcare costs from ageing populations starts to kick in, governments will have little room to manoeuvre. Businesses will oppose cuts to infrastructure spending, ageing electorates will rebel against pension and healthcare cuts, yet few will be happy about increasing taxes and/or rising public debt. Squaring this circle will be a significant challenge for governments over the coming years.

These, then are just some of the challenges to which businesses must adapt. To help us gain greater perspective on these and other critical factors, PARC is delighted to welcome leading economist Vicky Pryce as our guest speaker at Geopolitical and Global Trade Outlook to share with us her critical insight into the evolving global business environment. Her wealth of experience at government and international level will help us to understand and anticipate the challenges of the coming year and beyond.

UPCOMING PARC AND CRF EVENT

Geopolitical and Global Trade Outlook Briefing:

Online, with Vicky Pryce, 26 January 2022