Corporate Governance

Corporate Governance at a Crossroads – Why it matters for your business

Corporate governance is at an inflection point. It may be that much of what we thought we knew in 2020 will turn out to be wrong. The disappearance of mentions of ESG, Net Zero and Diversity & Inclusion from corporate statements has been remarkable for its speed. Rapid u-turns by former champions of the ‘purposeful corporation’ has left many wondering whether they ever meant it in the first place.

Over the past three decades, the concept of corporate governance has undergone a transformation, broadening significantly from its initial focus on shareholder interests to encompass an array of political, social, and economic questions. Born out of corporate failures and public outcry in the UK in the 1990s, the debate expanded to include a range of stakeholders beyond a company’s shareholders and managers, while embracing concepts of long-term stewardship, fairness, equality, and environmental protection.

The early 2020s, following the Covid pandemic, appeared to be the zenith of this expansion. Catastrophic climate events and global protest movements like ‘Black Lives Matter’ and ‘Me Too’ propelled the Net Zero imperative and diversity and inclusion firmly onto the corporate agenda. The CEO of Blackrock, the world’s largest asset management firm, even declared “a fundamental reshaping of finance,” stressing the importance of “serving stakeholders and embracing purpose”. Business groups, the World Economic Forum, and others rallied around the acronym ESG (Environmental, Social, and Governance), with the Financial Times remarking on a “notably different corporate zeitgeist”. The consensus was that “purposeful corporations,” ESG, and stakeholder capitalism were here to stay.

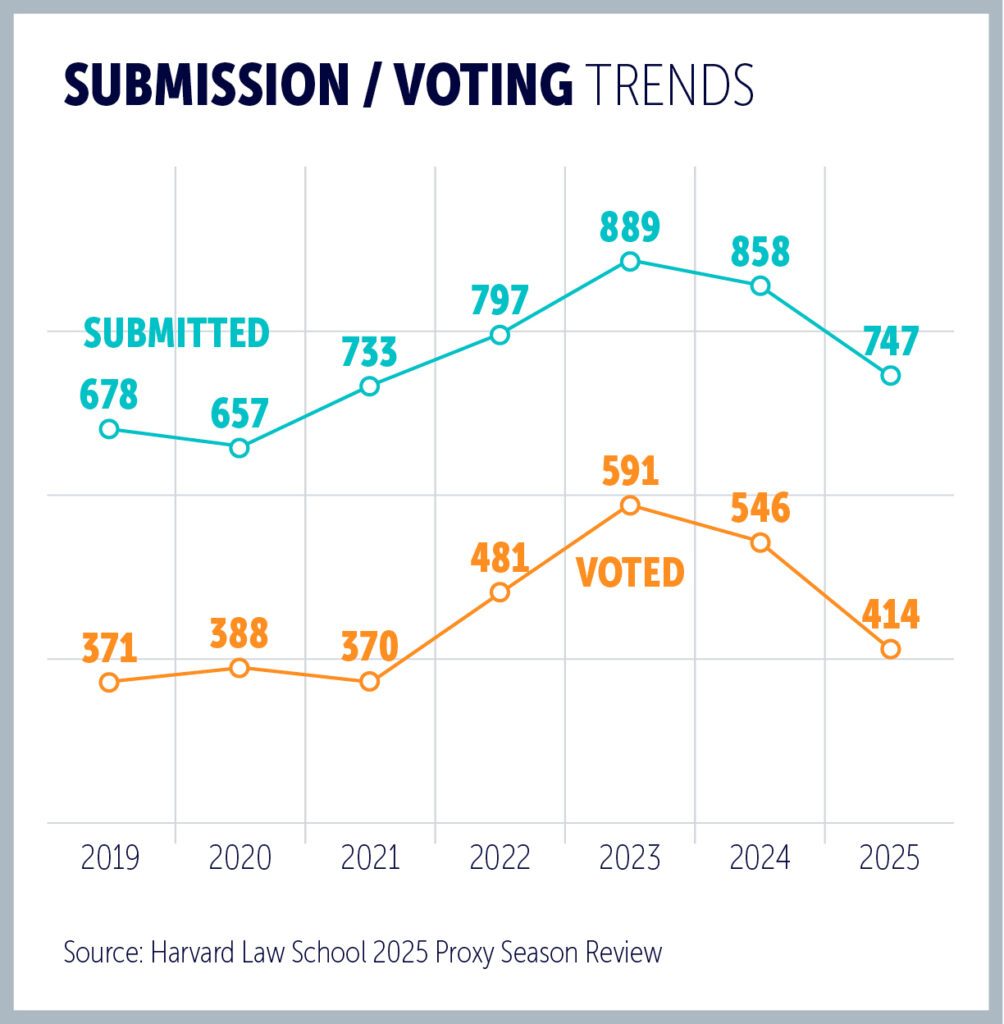

However, just five years on, the ‘zeitgeist looks’ notably different again. A significant backlash has emerged against ESG, DEI and even, to an extent, against Net Zero. As the 2024 US election approached, the change in the political weather began to have an impact on the rhetoric and behaviour of businesses. Corporate opinion started swinging away from ESG and other related areas such as Diversity, Equality and Inclusion (DEI). Acronyms that had been seen as symbols of a new style of capitalism only two years earlier were being dropped from corporate discussions and reports. Charts showing the number of mentions of ESG and DEI in earnings calls and annual reports read like ‘the rise and fall of woke capitalism’. Rising sharply from 2019, peaking in 2023 then collapsing to almost zero by 2025.

Business publications have reported on a corporate governance schism between the US and Europe – with the pushback against ESG and DEI strengthening in the US while Europe continues its focus on sustainability. Yet there is evidence of European companies reducing their emphasis on ESG and DEI too. This trend does not seem to be limited to those businesses with significant US operations. The US government’s assault on what, only five years ago, were the norms of corporate governance has either caught a sympathetic wave or else cowed corporations into what the FT called a “calculated silence”.

Consistent with the new prevailing mood, there are indications of a regulatory retreat in Europe:

- The EU’s Corporate Sustainability Reporting Directive (CSRD) was significantly de-scoped for non-listed entities in 2025.

- The UK’s 2025 Corporate Governance Code, published in 2024, ended up being less onerous than initially expected, dropping proposals related to diversity reporting and ESG responsibilities for audit committees.

- The UK Stewardship Code 2026 explicitly removed the phrase “leading to sustainable benefits for the economy, the environment and society” from its definition of stewardship, aiming for more streamlined requirements.

Meanwhile, in the US, the ‘attack on shareholder power’ continues. SEC measures making it easier for boards to block investor resolutions have taken effect. A record number of shareholder votes were denied in this year’s annual meetings.

This divergence in regulation poses considerable challenges for international companies, which may find themselves attempting to meet Net Zero, ESG and DEI targets in some jurisdictions while being actively punished for doing so in another.

Despite the political rhetoric and regulatory fluctuations, the underlying pressures that fuelled the rise of ESG – such as climate events and consumer attention – have not disappeared. There is talk of companies continuing to work on ESG and DEI initiatives but doing so ‘under the radar’ by using different language or simply not publicising it – a phenomenon recently dubbed ‘Greenhushing’. But if the senior executives and directors of companies really are making their operations more opaque to avoid political scrutiny, this surely goes against the whole ethos of corporate governance.

Corporate governance is currently at a critical juncture, with unprecedented political interference and the likelihood of conflicting, rather than converging, regulatory regimes globally.

For businesses, and particularly for Reward leaders, remaining vigilant and developing the capacity to scan and anticipate this changing environment will be crucial. As ever, the focus should remain on what is truly material to the business model and strategy but, in such volatile times, that can often be difficult to discern.

At PARC’s Corporate Governance event on Wednesday 17th September we will hear from three speakers who will give us insights into these developments and help us to anticipate the likely direction of travel. We will discuss the issues most likely to impact PARC members, and some potential strategies for responding to these developments.